October Yacht Market Report: Stable Conditions, Better Financing, Clearer Signals

Market at a Glance

Seasonal Transition

As we move into October, Southern California settles into one of the best stretches of the year on the water—warmer seas, lighter crowds, and a steadier rhythm that often carries well into November. It’s also when the cumulative signals from summer start to clarify where the market is headed next.

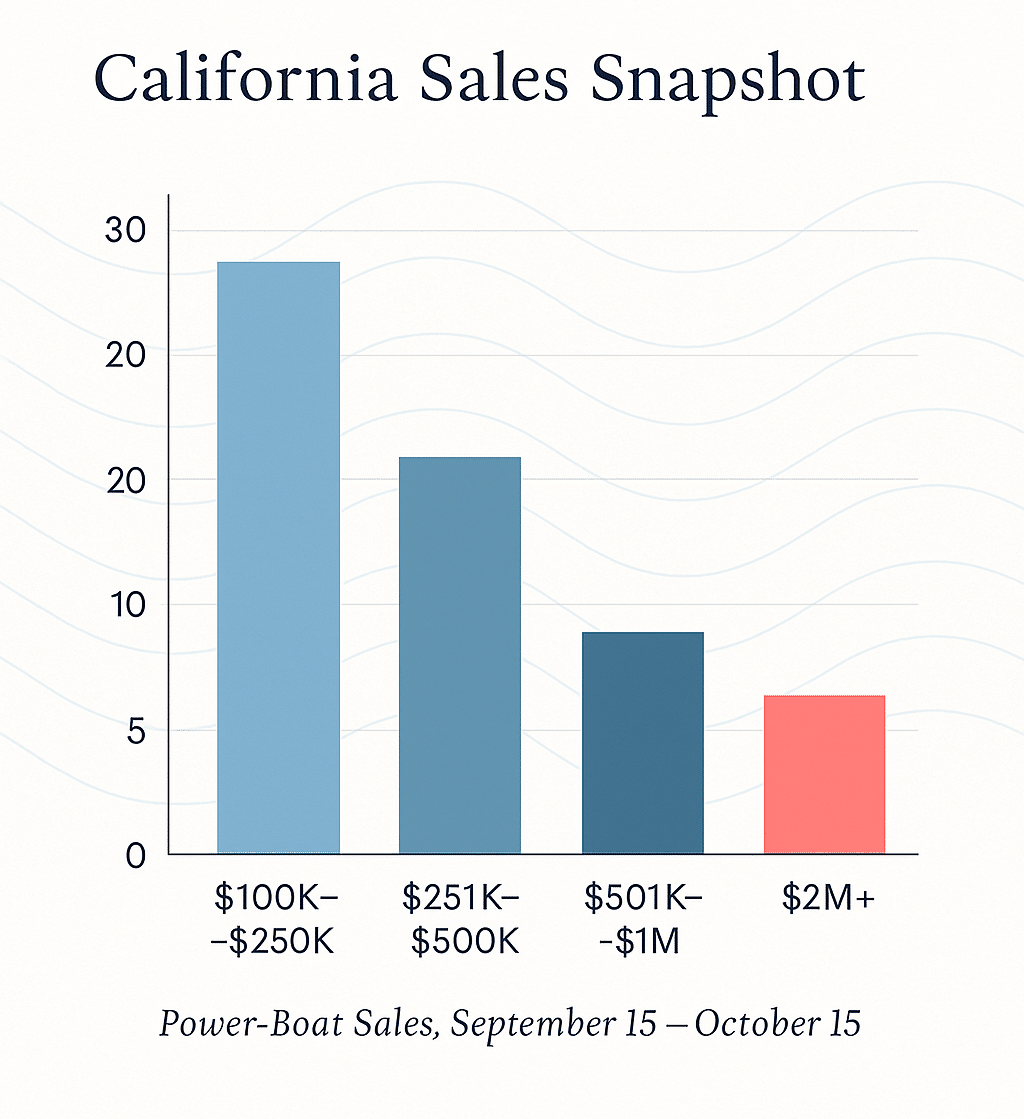

California Sales Snapshot (Power Boats, September 15 – October 15)

Reported power-boat sales across California show a typical late-season moderation following a strong summer. Compared with the previous period (August 15 – September 15):

- 28 boats sold between $100K–$250K (even with the prior month, 0% change)

- 22 boats sold between $251K–$500K (down 4, –15.4%)

- 8 boats sold between $501K–$1M (down 2, –20.0%)

- 1 boat sold between $1M–$2M (down 6, –85.7%)

- 2 boats sold above $2M in the past 30 days (up from zero last month)

The mid-market continues to represent the majority of overall transactions, showing the greatest consistency month to month. The higher-end categories, while more volatile in percentage terms, remain limited by smaller unit counts typical for this time of year.

Financing Environment

Macroeconomic Backdrop

The broader economy continues to show steady footing. Job growth and consumer spending remain firm, and inflation pressures have eased. The Fed’s rate cut has helped restore confidence across lending and capital markets.

Globally, continued calming in the Middle East has reassured investors and helped drive oil prices down into the low-to-mid $60s per barrel, easing fuel costs for both commercial and recreational operations. Tariff discussions remain ongoing, particularly for imported marine components, but overall, the global tone is more stable and supportive than it was earlier in the year.

Marine Insurance Market Update

There are encouraging signs emerging in the marine insurance market, which has started to stabilize after a few turbulent years. Several major carriers are re-entering the space or expanding their marine coverage capacity, and brokers are reporting a gradual improvement in both availability and underwriting flexibility. For boaters and buyers alike, that means more choice and fewer roadblocks than many experienced in recent seasons.

While the past couple of years brought tighter underwriting and some carriers pulling back, those changes have largely helped the market reset on firmer footing. With pricing better aligned to risk and claim trends normalizing, many insurers are now showing renewed confidence in the boating segment. The result is a market that’s more balanced, more predictable, and better positioned to support long-term growth.

Overall, the tone has shifted from constraint to cautious optimism. Specialty providers and regional underwriters are competing again, bringing new options to market. For current owners and those considering their next boat, the improving insurance landscape is one more positive sign as the broader marine industry regains momentum heading into 2026.

Marine Engine Market Snapshot – October 2025

Marine Engine Market Snapshot – October 2025

Outboard Segment

The outboard market continues to carry most of the momentum in the marine engine space. While total retail volumes are still running a touch below last year, sales of small- and mid-horsepower motors remain steady, fueled by consistent repower demand and solid activity among value-focused buyers. On the premium side, the 300-horsepower-and-up class continues to shine as boaters lean toward larger, high-performance setups.

Inventory levels at dealerships have largely balanced out after the past two correction years, allowing manufacturers to align production more closely with true retail demand. The result: a healthier, more stable outboard segment with firmer margins and fewer excess units sitting on lots.

Inboard Diesel Segment

Inboard diesel suppliers are also reporting a more stable backdrop, particularly on the larger yacht and commercial side of the business. Service and parts activity remains strong, helping offset softer demand in smaller leisure categories. The diesel sector continues to benefit from its connection to professional and higher-end applications, where buyers tend to be less interest-rate sensitive. Overall, diesel propulsion is holding its ground well and providing a steady anchor for the market as broader demand patterns normalize.

Industry Signals

National reports show a modest slowdown in new-boat deliveries, balanced by steady brokerage activity as buyers continue to prioritize value and immediate availability. Dealer inventories remain healthy, and late-model listings are increasing as the season transitions into winter.

Perspective and Outlook

While we’re only one company within a broad and varied market, we’ve seen a noticeable uptick in interest on the used-boat side over the past several weeks. Conversations, showings, and inquiries have all trended higher as buyers revisit opportunities that had been on hold earlier in the year.

New-boat sales remain slower overall in California, but that picture isn’t uniform across the country. Dealers in regions like Florida are reporting stronger new-boat activity, particularly in center consoles and sport cruisers, suggesting that regional demand patterns are still being shaped by local economic and lifestyle factors.

Overall, the tone feels more constructive than it did mid-summer—better financing conditions, lower fuel prices, improving insurance availability, and steady used-boat engagement all point to a market finding its footing as we head toward 2026.